Climate crisis puts millions more English homes at risk. Data illuminates the risk beneath

Diving into LexisNexis Risk Solutions UK & Ireland Insurance

By Harrison Sadler

Whether it’s the first rung of the property ladder or the last, finding a dream property, securing a mortgage and moving into a newly purchased home should be a time of joy.

However, as some younger homebuyers take on marathon mortgages of more than 30 years, many could also face the risk of subsidence in the future due to climate change.

Shrink, swell, heave, crack

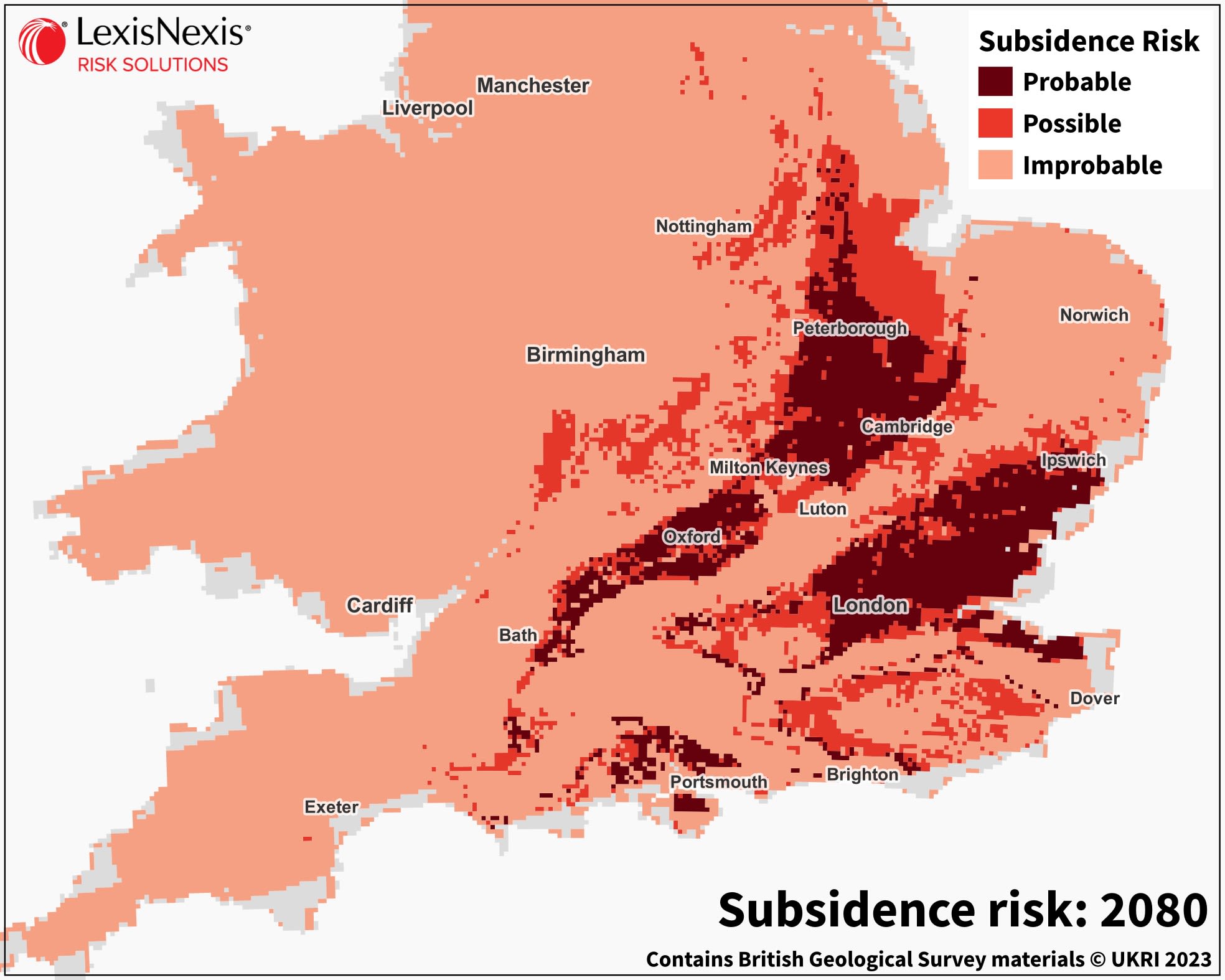

LexisNexis Risk Solutions analysis has identified that by 2050, 1.2 million more homes in England may be at risk of subsidence issues due to climate change. The analysis reveals that the areas most at risk form an arc stretching from the picturesque university towns of Oxford to Cambridge. With their proximity to historical cities, quick links to London, stunning countryside and more accessible house prices in certain towns, significant housing development is anticipated in this popular area over the next 30 years.

Photo by Liv Cashman on Unsplash

Photo by Liv Cashman on Unsplash

Despite its popularity, what lies beneath is more menacing, clay-rich soil. Though seemingly innocuous, this soil combined with our warming planet, is a big problem for homeowners and their insurance providers. When clay-rich soils absorb excessive water, the swelling pressures can cause the ground to rise and structures to lift, a phenomenon known as heave. In warmer, drier weather, soils can become very hard when dry. As a result, the ground shrinks and cracks, leading to subsidence and potentially costly property damage.

Sinking England adds up

Within the mortgage lifespan of today’s new home buyers, the cost of predicted shrink-swell subsidence over the next 26 years is a major concern. The 1.2 million increase in homes at risk, represents a 27% rise on top of the 4.5 million households already in danger today. In places like Milton Keynes, currently at low risk, an additional 28% of households will be at risk of subsidence by 2050. Swindon, meanwhile, will see the percentage of possible or probable ‘at risk’ households increase from 20,000 properties today to 64,000 in 2050 – a 219% increase.

Furthermore, areas that are already at risk will also see increases in the severity of subsidence – like Oxford seeing an additional 33% of households where subsidence is deemed probable (vs possible). The cost of subsidence is hitting insurance providers hard with the industry paying out a whopping 21% more in subsidence claims in Q2 2023 than in the same period in 2022, equating to £54 million.

The Value of Insurance

Subsidence is also costing policyholders dearly but it does highlight the very real value of insurance. The effects of subsidence would surely be financially ruinous to anyone without insurance, which is why these subsidence predictions pose serious risk for the quarter of UK homes (7 million) currently without home insurance.

Caroline Elliott-Grey, senior product manager, geospatial intelligence at LexisNexis Risk Solutions, is calling for enhanced awareness of the massive challenges of addressing subsidence in the coming years, as geological changes accelerate.

"It is essential that homeowners fully understand the financial risks of subsidence and are informed of their options so that they can take the right insurance and mortgage policies to protect their futures," says Elliott-Grey.

Leveraging data as a weapon against climate change

While the heat is on to educate homeowners on the challenges subsidence presents, the insurance industry is stepping-up to this growing perils risk by doing everything it can to continue insuring properties in ‘at risk’ areas. Responding effectively to our ever-changing climate means insurance providers need to use actionable insights from reliable data. In doing so, they can better assess risk, serve policyholders more effectively, contain costs and enable optimum decision-making, to keep policies affordable and within reach of the property owners who need them.

Heikki Vesanto, data scientist and manager of geographic information systems, at LexisNexis Risk Solutions, notes, "Increased risk of flooding is often talked about in relation to climate change in the United Kingdom, as it provides attention-grabbing photos of flooded town centres. Subsidence, on the other hand, is less often brought up in regards climate change, but will impact a significant percentage of households across the United Kingdom. With areas considered at low or no risk now becoming vulnerable, and those already vulnerable experiencing even more severe subsidence."

Geospatial data intelligence using predictive models, scores and indicators can be the insurance professional’s ally in understanding, managing and mitigating environmental claims, and this data intelligence is growing in response to the increasing risks the market and its customers are facing.

Getting to the root of the problem?

This includes data on the distance and height of trees in relation to insured properties knowing that trees are implicated in 70% of reports of subsidence and heave on clay soil. The root spans of fully-grown trees can vary from eight metres for a pine to the imposing 40 metres diameter of a willow’s roots. The impact of the root system is, on average, as wide as the tree is tall. With these roots absorbing huge amounts of underground water, soil can be dried out under buildings to damaging levels. In fact, during drought conditions, a thirsty tree may remove more moisture from the soil at one side of a building than the other, meaning that side of the property will subside quicker, resulting in structural damage.

"Knowledge of what trees surround a property can therefore prove vital when pricing a policy," says Elliott-Grey.

Assessing the risk at individual building level

Data on the average of, or expected, weather conditions, coupled with soil type, soil shrink and swell and likelihood of landslides already enables a risk score to be created which can be used in insurance pricing, providing an indication of a property’s propensity to subsidence. Add to this mix key data for trees across England and Wales and it is possible to gain an even clearer picture of subsidence risk.

Photo by Olivier Collet on Unsplash

Photo by Olivier Collet on Unsplash

Where once a whole village may be given the same risk score, or one street will be given a single score, with tree data added the risk prediction comes down to individual building level. It is then possible to distinguish between high risk buildings and, for example, the buildings in high clay areas which are lower risk than the area average as they are not close to any trees.

Basement insights

Basements can also give rise to subsidence issues for the property and potentially those surrounding it, providing further reason for insurance professionals to exploit newly available data on the presence of basements.

LexisNexis Basements Indicator combines multiple data sources to create a unique attribute that helps property insurance providers identify whether a basement or an underground level may be present in a home or a commercial building. Flash floods are becoming a regular occurrence[i] in many urban, high-density areas due to the reduced permeability of surfaces, clay soils, and ageing drainage and sewage systems. The power of LexisNexis® Basements Indicator increases further when evaluating subsidence risk. New basements in particular can exacerbate subsidence risk for the building itself and those around it.

Structural supports constructed into deeper, denser clay mean that part of the building moves less than the rest, resulting in differential subsidence. The modern basement will also be made completely waterproof, causing lakes to form underground. This occurred behind the Royal Free Hospital and was responsible for the major subsidence of St Stephen’s Church.

These insights on the subsidence risk can be used in combination with historical claims data for the property as well as data on the property characteristics, right down to the individual address. The more granularity and spatial accuracy in the predictions, the more accurate and fair the pricing, as well as the crucial ability to better manage risk as subsidence becomes more likely.

Helping policyholders to help themselves

As Caroline Elliott-Grey so clearly stated, homeowners need to be made aware of the risks of living in an area at high risk of subsidence. Lee Jones, Project Leader for Ground Based Geomatics Surveys at the British Geological Survey agrees.

“Whilst we should be careful to note that these are projections, property owners can help to limit the potential effects of future subsidence-related issues. Steps property owners can take are to be aware of the effects of laying impermeable drives, paths or hardstanding and of planting or removing trees close to properties, which can all have an impact on soil moisture profiles," says Jones.

Photo by Benjamin Cheng on Unsplash

Photo by Benjamin Cheng on Unsplash

Insurance providers can do more to educate homeowners who live in areas of shrink-swell clay. The following advice might be helpful to policyholders in at-risk areas:

Six steps to help address climate-related subsidence

- Take specialist advice before starting major building work.

- Consider what effect laying impermeable surfaces or hardstanding may have on the rainfall reaching the soil below and changing its moisture content.

- Ask advice before planting trees near a property. The safe planting distance will vary, depending on the tree species, the building’s foundation and soil composition.

- Double check foundations of extensions are designed for any shrinkable clay soil conditions that are already there, or forecast under future climate conditions.

- Do not plant trees which will grow large next to a house.

- Take advice before moving large trees near a property as it is important to maintain a stable soil moisture profile.

Avoiding that sinking feeling with data

The enormity of the challenge presented by climate change cannot be ignored. The Met Office ‘State of the UK Climate’ report highlights that in the UK temperature extremes are changing much faster than the average temperature. What’s more, five of the 10 wettest years for the UK in a series from 1836 have occurred in the 21st century so far.

With warmer summers set to become the norm in as little as a decade, subsidence surges are likely to become increasingly common. The good news is that data can be the insurance sector’s ally in helping to more accurately predict and protect customers from subsidence risk.