PANDEMIC FRAUD

How aid for struggling Americans let loose a hornets’ nest of criminals

The largest financial rescue package in history attracted an onslaught of fraud against government programs that shows no sign of abating and is destroying lives across the country

OVERVIEW

In March of 2020, millions of Americans were struggling with the fallout of Covid-19. In addition to the health emergency and devastating loss of life, the economy was tanking. Jobs were being lost and companies were on the verge of bankruptcy.

In response to the crisis, the administration rolled out a vast financial rescue package. But one unintended consequence was fraud on a vast scale. Government largesse mobilized networks of criminals, like a rattled nest of hornets.

These criminals are out to sting the government and citizens in any way they can. The most common approach is to steal the personal or confidential data of individuals and companies and use their identities to apply for government benefits.

In some government programs, fraudulent payouts may have run into the hundreds of billions of dollars, according to official figures. Across unemployment insurance schemes, at least 21.5 percent or $191 billion was paid improperly, the General Accountability Office estimates.1 The Small Business Administration (SBA) disbursed over $200 billion, or 17 percent of its total loan assistance, to potentially fraudulent claimants.

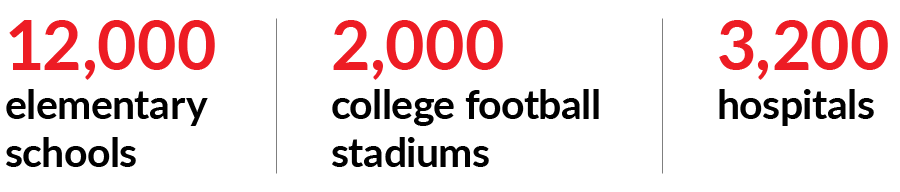

Applying similar rates of loss to the roughly $5 trillion in Covid aid, improper payments could be as high as $1 trillion, according to a LexisNexis Risk Solutions estimate.

That is enough money to build:

These large sums are difficult to grasp. That amount can feed two million families for four decades. What’s perhaps easier to relate to is how victims of fraud have had their lives turned upside-down. Waking up one day to realize that your credit history is tainted, your long-awaited tax refund is stolen, or your medical records have been tampered with so you can’t get life-sustaining medicines, is what hundreds of thousands of Americans have had to endure, according to various government watchdogs.

“It’s mean, it’s chaos. The criminals are the only ones who have their ducks in a row and nobody else knows how to deal with them. They’re just taking money left and right. It’s depressing.”

ABOUT THE VICTIMS

WHAT THEY SAID

“Found out that the individual has collected more than $200,000 in my name; my life is just ruined.”

“A second unemployment application was made some time after the first one. I reported that one also. Later in the year, my credit-card information was stolen and used to create a card which was used to try to buy goods in Illinois.”

“I do not associate with any people on a personal level at all. I’ve totally isolated myself for over three years.”

WHAT THEY WENT THROUGH

Survey shows 75 percent of victims feel ‘violated’ and 16 percent of victims feel suicidal2

Victims of medical identity theft face ‘life-and-death’ situations

Majority of victims develop problems with family and friends

70 percent permanently locked out of their social media account2

HOW IT ALL STARTED

A GIFT TO FRAUDSTERS

During the pandemic, the government was handing out unprecedented amounts of money and was in a huge hurry to do so. The requirement to apply for aid in person was suspended due to the pandemic, meaning that all applications were processed online, but without the proper verification mechanisms in place. For many criminals who had been trafficking drugs or practicing white-collar crimes, it became easier and less risky to steal money from the government and from needy Americans.

“The agency weakened or removed the controls necessary to prevent fraudsters from easily gaining access to these programs and provide assurance that only eligible entities received funds,” according to a review published by the SBA’s Office of Inspector General (OIG) in June of this year. “However, the allure of ‘easy money’ in this pay-and-chase environment attracted an overwhelming number of fraudsters to the programs.”

The volume of applications for benefits became so large that authorities were utterly overwhelmed. “Within two to three weeks, initial claims rose to 10 times pre-pandemic levels, far higher than state systems were designed to handle,” says Larry D. Turner, inspector general of the U.S. Department of Labor, who told the House Committee on Ways and Means about the issue in February 2023.

The under-staffed agencies were also woefully unprepared to tackle ever-more sophisticated criminals. “The government has antiquated systems, processes and technologies,” says Haywood Talcove, CEO Government, LexisNexis Risk Solutions, which offers risk-management solutions based on data and advanced analytics.

“Private enterprises, while also the target of hackers and online fraud, have moved faster to upgrade their fraud-prevention systems to keep their businesses safe and also because regulators and shareholders demand it. Businesses tend to dedicate more resources to crime prevention and have better technology,”

WIGGING IT

Facial-recognition software used by the government is so flawed that one man from New Jersey was able to cheat California out of more than $3 million in unemployment payments by posting pictures of himself in curly red and orange wigs.

But typically, fraud schemes are far more sophisticated and involve not only small-time grifters but also domestic gangs and even international criminal organizations. At least one case of fraud was linked to hackers backed by the Chinese government.

The most typical scam is based on identity theft. Criminals steal personally identifiable information such as a name, date of birth, and social security number of individuals from databases or out of mailboxes.

Scores of innocent Americans find their personal data being sold on the dark web to fraudsters, who then turn around and file false applications for government benefits from unemployment insurance to emergency loans. For the criminals it’s as easy as buying a pair of tennis shoes online.

Other methods involve the cloning or skimming of electronic benefit-transfer (EBT) cards used by recipients of the Supplemental Nutrition Assistance Program (SNAP), previously known as the Food Stamp Program.

FROM GROCERY STORE TO NIGHTMARE

Unbeknownst to a needy mother buying milk or bread at the local grocer with her EBT card, a skimming device on the retailer’s credit-card terminal copies and transmits her data to be used on another swipe card. At some point she realizes not only that her entire monthly allowance is gone, but that she may have trouble feeding her family for weeks or months until the case is sorted out.

Stores themselves are also targeted and the number of scams is seemingly unlimited. The problem became so big that the United States Department of Agriculture (USDA) has issued several warnings about it. “Identity theft is one of the fastest-growing crimes in America, affecting millions each year,” Jeffrey Brown, deputy assistant inspector general at the Social Security Administration Office, told the House Committee on Ways and Means in May.

Not only are their benefits gone, but often an entire life of hard work is tainted by crimes they didn’t commit.

“They are absolutely distraught because the way they find out they are a victim is when they go to apply themselves, which hosts a hotline to help victims. They need those dollars to which they are entitled to meet their basic needs, put food on the table, and pay rent or mortgage.”

HUNGRY CHILDREN

In Minnesota, a quarter of a billion dollars that was supposed to go to feed needy children during the pandemic went into the pockets of fraudsters, who created hundreds of shell companies, submitted falsified meal count sheets, as well as fake documents and invoices.

“This was a brazen scheme of staggering proportions,” U.S. Attorney Andrew M. Luger for the District of Minnesota said when the charges were announced.

“These defendants exploited a program designed to provide nutritious food to needy children during the Covid-19 pandemic. Instead, they prioritized their own greed, stealing more than a quarter of a billion dollars in federal funds to purchase luxury cars, houses, jewelry, and coastal resort property abroad.”

But it’s not just the needy who get scammed. One business owner lost $2 million when criminals stole his mail with tax refunds from the IRS. They created a fictitious company with a virtually identical name to that of his, opened a bank account in that name and deposited the refunds in that account. Professor Maimon uncovered the scheme when he saw the man’s IRS check for sale on the dark web.

NO HOME, NO HELP

The lives of innocent people are plunged into chaos when they become victims of identity theft. Take the case of Steven and Gloria Clark from Des Moines, Iowa. They had been saving for years to buy a house for themselves and their two daughters. But the dream went up in flames when the IRS came knocking on their door to say they owed $5,000 in taxes for $30,000 in unemployment funds they allegedly received from the state of California. They never received any aid, nor worked or lived in California.

Nearly two years later, the case hasn’t been resolved and while California recognizes the scam, the IRS doesn’t.

“It’s not, you know, innocent until proven guilty. You’re just guilty, and then you have to prove you’re innocent. I just went through the stages: shock, upset, confused. And then almost irate.”

Like the Clarks, many victims are stuck in a bureaucratic quagmire for months or years before they can clear their names and recover their lives.

One woman who was the victim of medical identity theft was subjected to a criminal investigation and saw her kids questioned by child-protection services at school because the criminals used her identity to buy opioids and other drugs. Healthcare scams have skyrocketed since Covid, particularly targeting older adults or those with long-term issues.

DEFRAUDED FROM BIRTH

Velasquez, the ITRC CEO, tells of newborn children who receive a social security number that already has a negative credit rating because criminals have misused it and built a fake identity around it for years before it was even issued.

Not surprisingly, victims feel vulnerable and violated.

“They don’t understand how they became a crime victim. How did this happen, how did the state government not know, how did the IRS not know? How did the bank not know?”

Ten percent of those polled by ITRC in 2022 felt suicidal. Perhaps what is most disconcerting is that there are no signs of the crime wave abating. While the Covid pandemic may be over, the criminal activity it unleashed isn’t. The number of calls to the ITRC hotline in 2021 was the highest in over two decades. A year later, that figure remained virtually unchanged.

In fact, criminal gangs are moving from one government benefits program to another, always seeking out the weakest link in the chain. And with the onset of AI and deep-fake technology, their advantages over government defenses are growing.

SOLUTIONS WITHIN REACH

FRAUD PREVENTION RESOURCES

“The fraudsters are smart; they’re constantly looking for vulnerabilities and new ways to defraud the government. They adapt and innovate every week,” says Georgia State University’s Professor Maimon.

What is needed is a boost in fraud-prevention resources, more cooperation between government agencies and law enforcement throughout the country and, above all, a quantum leap in technology.

While the private sector has faced its own challenges, a look at the information and analytics tools which have been proven to be effective with big banks and online retailers would go a long way to defeat the biggest assault on American institutions and citizens in recent history.

Boosting the use of multi-factor authentication — behavioral biometrics, artificial intelligence and data-driven identity verification are some of the most common tools that have provided the best results.

“If we don’t do anything, we’ll lose another trillion dollars over the next 12 months and that money goes to organized criminal groups who use it to expand their operations. If the public sector employed information and analytics to assess if you are who you say you are, this kind of identity fraud would be shut down.”

Sources: 1. Improper payments may include payments made to ineligible claimants; according to the Office of Inspector General of the U.S. Department of Labor a "significant portion" is attributable to fraud. https://www.oig.dol.gov/public/testimony/02082023.pdf

2. Identity Theft Resource Center